Wouldn’t it be great if there’s an easy and convenient way to make your purchases without paying in full, especially when you’re a little tightly strung? Most of all, it allows you to split your purchase into different monthly instalments minus the hidden interest or fee charges. And no, we’re not talking about credit cards but rather the Buy Now, Pay Later (BNPL) platforms. They sure come in handy for those who are planning to buy an expensive or large purchase. Long story short, it’s time to shop smarter with these 7 Buy Now, Pay Later Platforms.

1) Atome

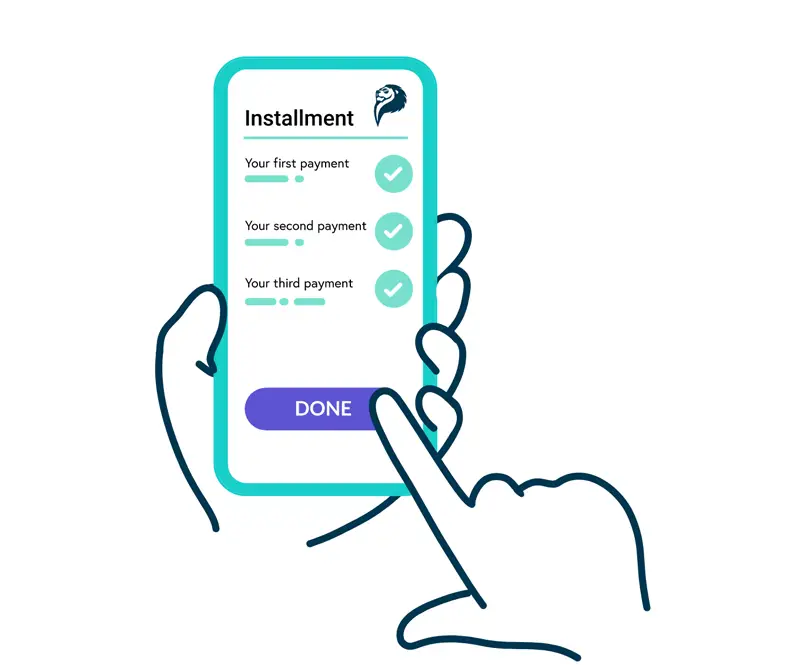

What do famous brands like Zalora, OSIM, Starbucks and Universal Traveller have in common? Well, they are among the 2,000+ retailers that support the Singapore-based BNPL platform called Atome. Pronounced as “a-toe-me” (not “a-tome”), this famous BNPL platform can be used in participating stores both online and offline. Assuming you choose to shop online, simply look for the “Atome” logo and select it during checkout. It will automatically split your total bill into 3 equal payments.

For instance, if your product(s) cost RM1,200, you are only required to pay the first payment of RM400 at the point of purchase. The rest of the 2 payments will be spread 2 months apart (30 days each) with the subsequent amounts of RM400 (x 2).

The good thing about Atome? There are no hidden charges or interest whatsoever. Of course, if you happen to make a late payment, you will be penalised with an admin fee of RM30 (the maximum charge is RM60).

Download the Atome app here or here.

2) Hoolah

Here’s another BNPL platform from Singapore similar to Atome. Hoolah supports various online & offline retailers from different categories, covering the likes of Al Ikhsan Sports, WOWSHOP, All IT Hypermarket and Decathlon Malaysia, just to name a few. Their BNPL method, in the meantime, is split into 3 interest-free instalments over 3 consecutive months. You just need to pay 1/3 up front for the first month using a debit or credit card. According to the Hoolah website, those who miss the payment will be charged from RM7.50 to RM75.00, depending on the order value.

Download the Hoolah app here or here.

3) myIOU

Flexibility best describes the myIOU platform. You can choose to split your purchase into 2, 3 or 6 monthly payments and yes, there will be no interest incurred whatsoever. To qualify for myIOU’s BNPL programme, you need to be at least 18 years old and above with a local debit or credit card. You will also receive instant credit approval for up to RM1,000 after registration. But if you need to increase your credit limit by up to RM3,500 or RM10,000, you can do so by submitting the following documents. As for the late or overdue payment fee, myIOU charges RM5.00 or 1%.

Download the myIOU app here or here.

4) PAYLATER

PAYLATER makes BNPL easier by offering 4 interest-free instalments, where it splits your purchase into 4 consecutive months. Here, you are required to pay 25% as your first payment upon checkout. PAYLATER doesn’t just accept local debit & credit cards but also FPX payment and direct debit services. And in case you need more instalments, simply request it in-app after your first payment. The instalment extension is available for up to 6 months (for RM999.99 and below), 12 months (for RM1,000 and above) or 24 months (for RM3,500 and above). Some of the participating merchants include All IT Hypermarket, Aihome, DJI, Gamers Hideout and Metrojaya. Keep in mind that a late penalty charge of RM10 for every 7 days of non-payment will be imposed for the checkout value between RM50 and RM10,000.

Download the PAYLATER app here or here.

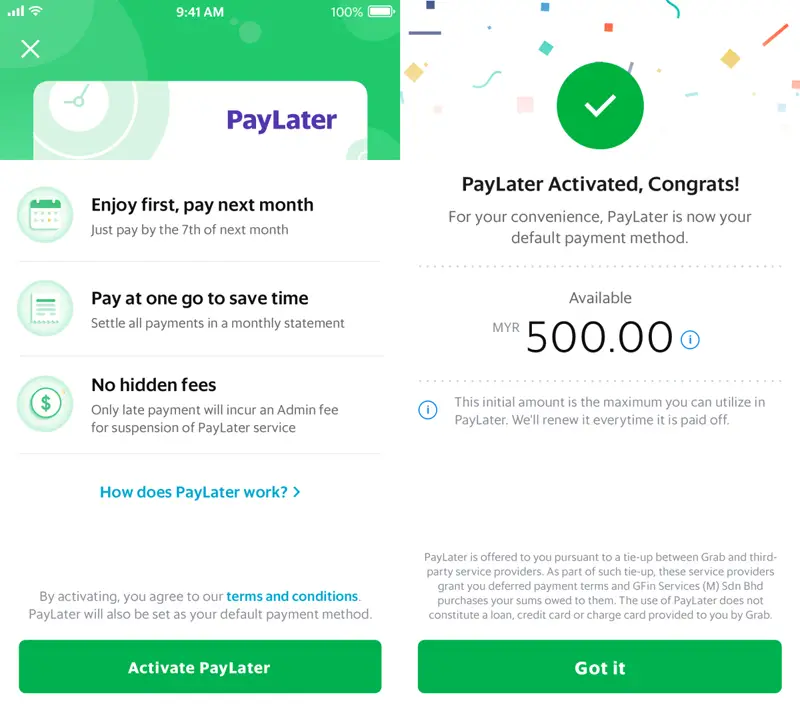

5) PayLater by Grab

Did you know that Grab has its own BNPL platform? It’s called PayLater and here, they offer 2 modes of payment to choose from. You can either split your purchase into 4 monthly instalments, where you only have to pay 1/4 up front for your first payment.

Alternatively, you can pay for the items or the Grab services in a total amount the following month. And if you choose the latter, you are even entitled to earn 96 GrabRewards points. There are no fees and interest incurred if you pay your bills on time. Otherwise, an RM10 admin fee will be imposed if you miss a payment and the fee in question is for reactivating your frozen/suspended PayLater account. The maximum late payment fee is capped at RM30.

Download the Grab app here or here.

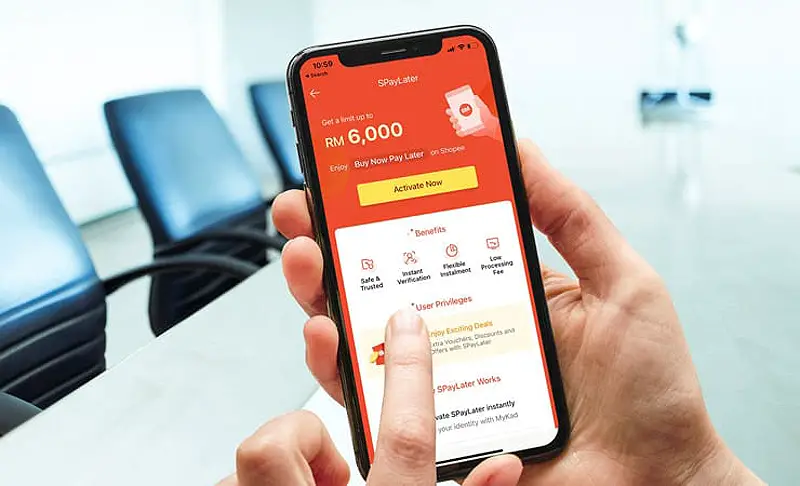

6) SPayLater

If you are a frequent Shopee customer, you might find their SPayLater useful. This is especially true if you make an expensive purchase, say a laptop that costs RM5,000 (keep in mind the credit limit is capped at RM6,000). Simply go to your Shopee app and look for the “Me” tab on the bottom right. Click on it and click “SPayLater” located on the “My Wallet” column. From there, you need to activate it beforehand (click the “Activate Now” button) and follow the instruction.

SPayLater has 4 different tenures available including 2, 3, 6 or 12 monthly instalments (according to the app, the latter is only applicable for selected users). But there’s a catch, though since there will be a 1.25% processing fee incurred on a monthly basis no matter which one of the four tenures you end up choosing. You also need to keep in mind that if you miss a payment, you will be imposed a 1.5% late fee on a monthly basis.

Download the Shopee app here or here.

7) Senheng PayLater

Senheng allows customers to use the BNPL approach for the product(s) that cost between RM500 and RM7,500. You can choose to split your purchase into 3, 6, 9 or 12 monthly instalments. For more info about Senheng PayLater regardless of application or FAQs, click here. Do keep in mind that Senheng PayLater is only applicable for PlusOne members (register here to join their membership).

Download the Senheng app here or here.

Enjoyed this article? You might be interested in checking out this one as well!