Our twenties are a time of transition, change, learning and navigation. There’s a lot of questioning going on, and maybe some wondering about what you’re doing with your life. This is pretty common and part of adulting, so if you’re twenty-something and reading this, you’re not alone! However, there are some things you can do, or should know, during your twenties. With these 6 tips for every twenty-something out there, here’s to your twenties!

1) Develop Self-Compassion

In very basic terms, you can define self-compassion as being kind to oneself. Oftentimes we are compassionate towards others, but sometimes not to ourselves. Think about it: we readily provide a helping hand, listening ear, or encouraging words when others are going through a rough patch, but we may be hard on ourselves when we go through a tough time or experience. Just as we are kind to others, we should also remember to be kind to ourselves. Being kind to yourself can build resilience, and help you navigate life better in the long run.

2) Don’t Compare

People in their twenties vary in their life stages greatly even though they may be at the same age. Twenty-somethings could be single, married, with kids, still studying, extremely successful, job-hunting… wherever you are, that’s good and fine. Everyone goes through life differently, and constantly comparing yourself to others is not helpful. Take it at your own pace, and enjoy every step of the way–you’re never going to get this time back, and we suggest you use it to do something else other than comparing.

3) Take More Risks; Just Do It

It’s understandable that you may feel like you don’t know anything, you’re bad at a certain thing, you’re afraid of failure, or you’re just unsure and afraid in general. These feelings are perfectly normal, but this is a time for learning and experience! In fact, the biggest regret most people have is that they didn’t take any action. So think about what you want to do, and just do it–what matters is that you act on it. Each action will be a learning experience, and you’ll thank yourself for it in the future!

4) Educate Yourself On Current Issues

There are so many things going on in the world right now, and if we read history correctly, there will always be new issues. It’s important to learn about current issues, and how to make a difference. Collectively, we desire a better world to live in, and everyone can make a difference. With knowledge of current issues, you can then make better choices, whether it’s actively participating in a movement, founding an organisation or even something as simple as voting for the candidate you believe in to make changes.

5) Take Care Of Your Health

This seems like a given, but many of us actually forget to do it regularly and consciously. Of course, basic ways to take care of your physical health include eating healthy food, drinking lots of water and exercising, but do you really do that? It’s imperative to take care of your health as much as possible to avoid falling sick, though critical illnesses can strike anytime. (More on that later!) Physical health aside, our mental health is just as important. It’s easy to feel overwhelmed with everything that’s going on, and sometimes you just need a break. A few ways to take care of your mental health include digital detoxes, meditation, having someone to talk to and having me-time.

6) Get To Know More About “Adult” Topics

Um, not that kind of “adult” topics. We’re talking about things like taxes, property and insurance. (Seriously, they should really teach these in school.) Learning about how to file income tax, own a property and buy insurance can be hard, so we’ll help you out a bit here with life insurance. Maybe you haven’t given it a lot of thought, but insurance coverage is crucial, as it is a form of financial security during an unexpected event or emergencies, say an accident, death or critical illness.

Critical illnesses can be defined as illnesses which are long-term and affect your health severely. In Malaysia, some of the most common critical illnesses include heart attack, stroke and cancer. Typically, critical illnesses deliver a large impact not just due to its physical effects, but the patient’s recovery journey may take a long time and he/she may need to make significant adjustments to his/her lifestyle. One could be incapacitated, face loss of income and suddenly weighed down by several expenses all at once. Without proper planning, this could be a serious blow financially, resulting in more stress on top of the illness. Back to the topic at hand, a critical illness insurance plan can provide you with financial protection in the event of a critical illness, so keep reading to find out how with PRUMy Critical Care!

For the uninitiated, this could sound a lot like a medical insurance plan. Spoiler: it’s not. Medical and critical illness insurance are two different things, and here are some of the key differences.

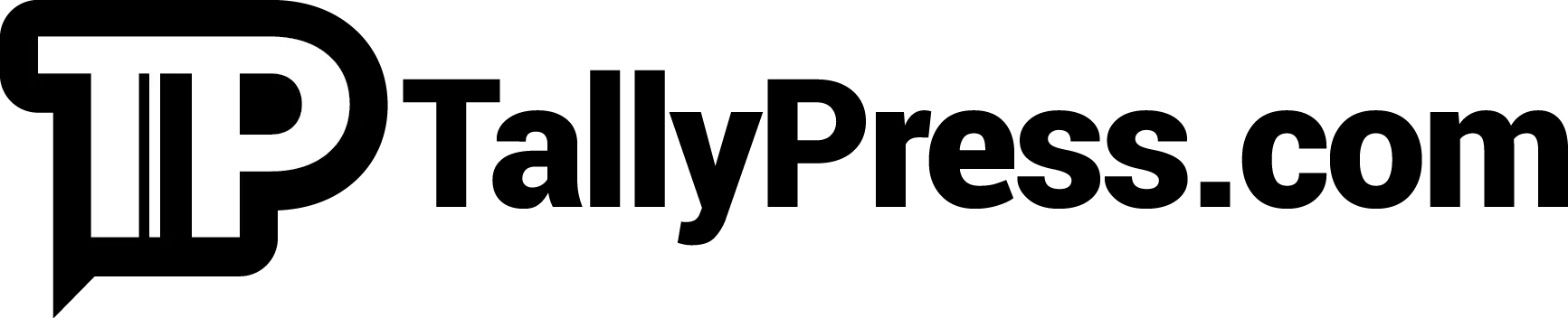

Medical insurance: Pays for the medical expenses including treatment, medication and hospitalisation. Payout does not go to you, but the medical facility at which you sought treatment. There may be annual and lifetime limits depending on the plan you opt for.

Critical illness insurance: Upon diagnosis, the policyholder receives a lump-sum payout. The payout is not restricted to medical treatment; it can be used for anything e.g. income replacement, paying for daily expenses, hiring help etc. It can also be used for alternative medicine if you choose so, since medical insurance does not cover alternative treatment costs.

PRUMy Critical Care

A critical illness solution by Prudential Assurance Malaysia Berhad, here’s what it is and what it covers:

- Provides comprehensive financial protection against 160 critical illness conditions, including liver failure, Parkinson’s disease, heart attack, stroke and cancer

- Coverage up to age 100 for early, intermediate and late-stage detection

- Allows multiple claims in all stages for up to a total four times of the rider sum assured

- Provides protection in the event of re-diagnosis for three of the most prevalent illnesses: heart attack, cancer and stroke

- An additional 20% of the rider sum assured for diabetic and joint-related conditions

- Customisable solution from only RM100 per month

Having medical insurance alone may not be enough. Critical illnesses are literally life-changing, and you will need all the financial protection you can get to focus on your recovery. Let Jeslinda Paul, a spinal cord injury survivor, tell you about it.

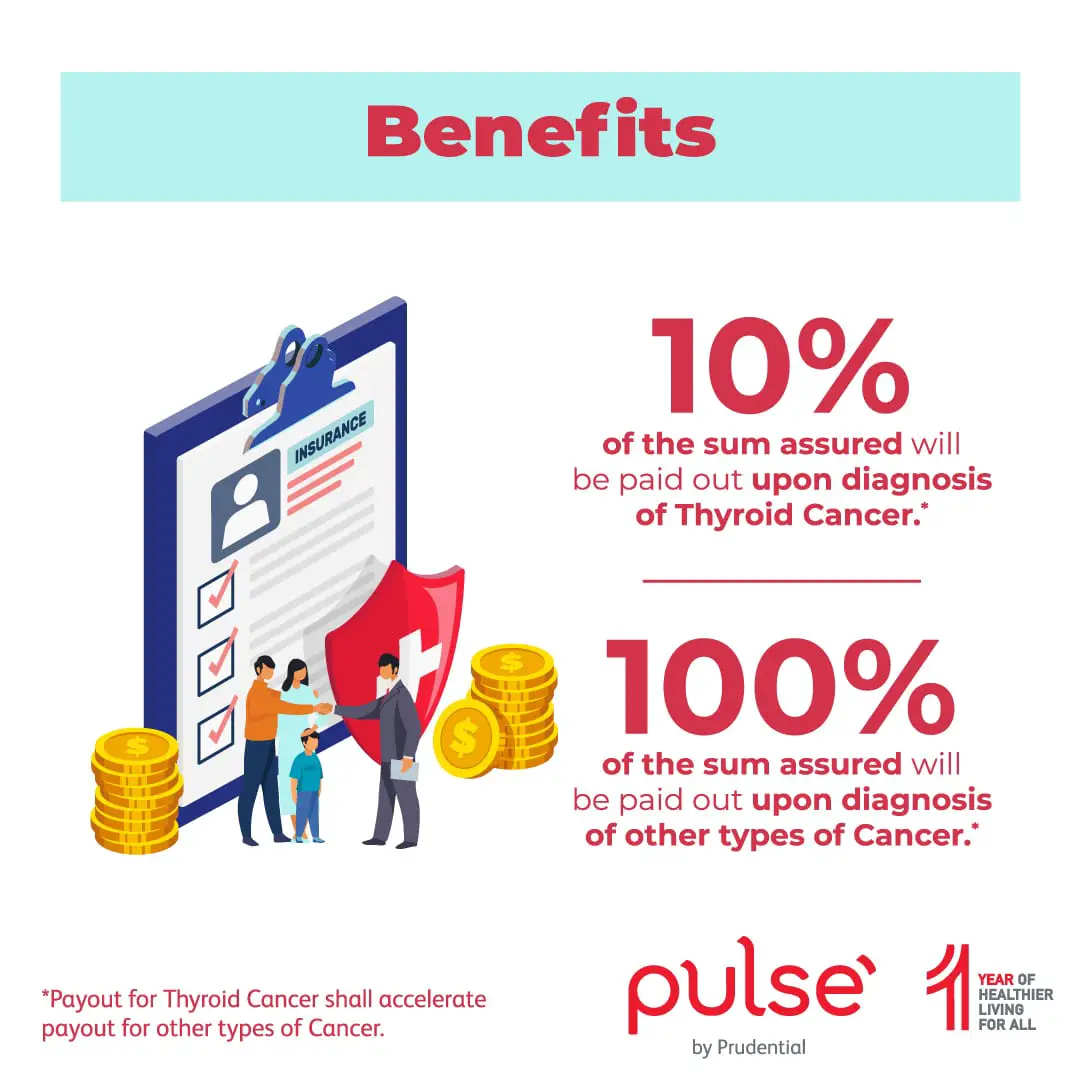

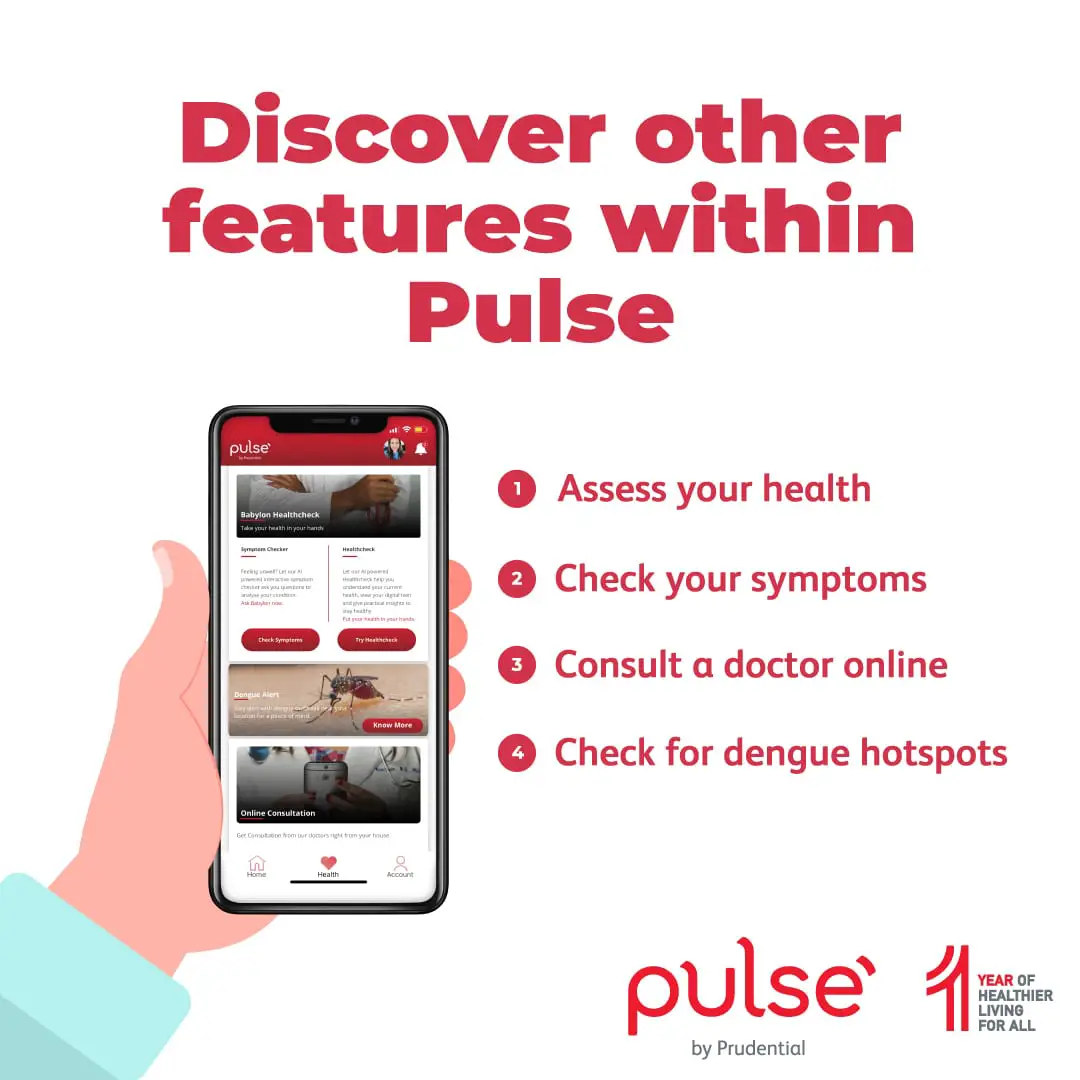

While you’re considering making critical illness protection a #lifegoal, why not get free protection and stay fit at the same time as a start? Prudential has also just launched a free cancer coverage challenge: #StepUpAgainstCancer Challenge, which is exclusively available on its Pulse by Prudential app. This challenge is open to non-Prudential customers who are Malaysian Citizens aged 19-50 on their next birthday.

What is this #StepUpAgainstCancer Challenge all about?

Earn up to RM12,500* free cancer coverage by taking daily steps.

How does it work?

Users who sign up for the challenge are also automatically eligible for Prudential’s Special COVID-19 Coverage. The coverage provides a RM1,000 cash relief upon diagnosis and hospitalisation, as well as a RM10,000 death benefit due to COVID-19.

Download Pulse now and sign up for the challenge: https://onepulse.page.link/ZJfz, or visit the #StepUpAgainstCancer Challenge page for more information!

With that, we urge you to take this into serious consideration, as critical illnesses do not discriminate between age or gender, and they certainly do not care about your dreams. For more information, speak to a Prudential Wealth Planner, or click here for information on how you can be financially prepared for critical illnesses!

*Terms & Conditions apply

We hope that every twenty-something has found this useful, and feels better about where they are in life! Once again, here’s to your twenties!