Did you know that by 2020, Malaysia aims to be a cashless nation? In line with that, e-wallets have been sprouting up seemingly overnight in recent years, with Bank Negara Malaysia actually having issued well over 40 e-wallet licenses thus far. While cash is still relevant, more and more are turning towards e-wallets, as they are more secure and convenient. Plus, each e-wallet has its own perks and rewards, encouraging users to use them more. Here, we have 6 e-wallets in Malaysia that you could and should use to go cashless!

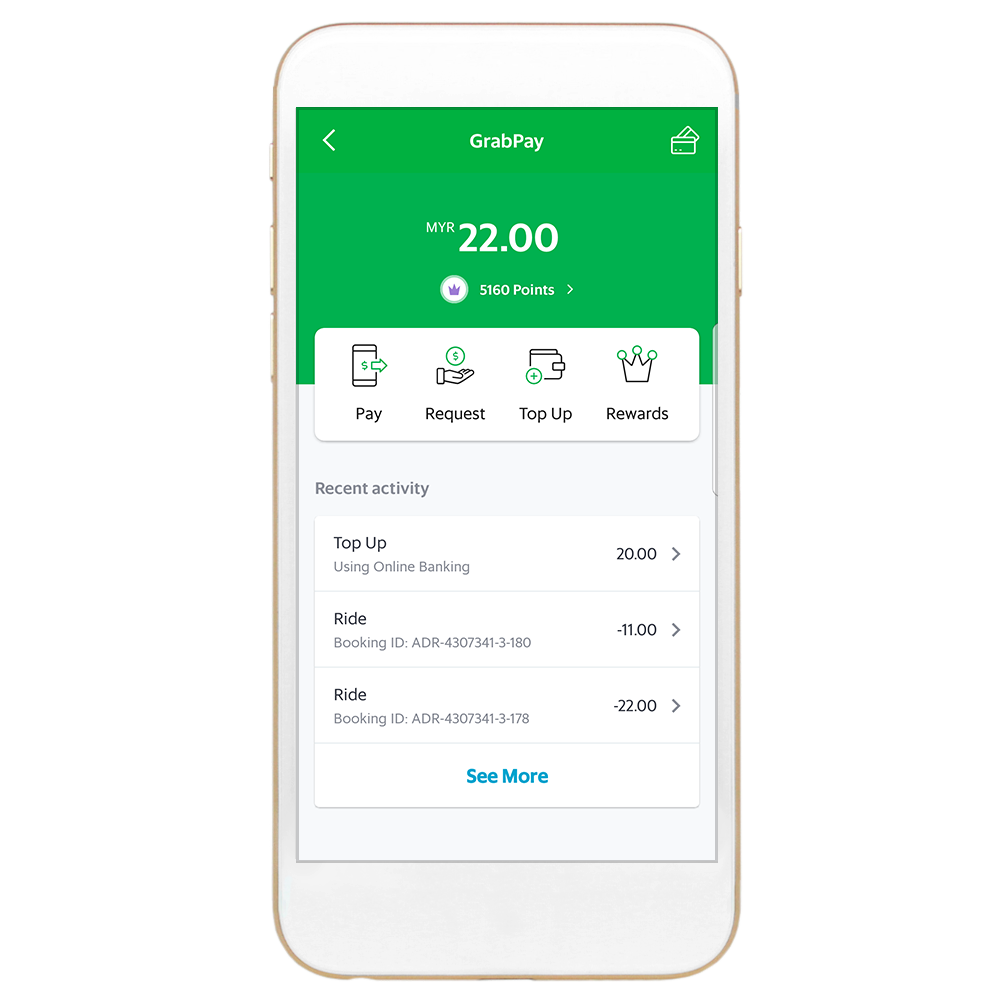

1) GrabPay

You should have saw this coming, honestly. Grab has already taken care of your transport and food, so it makes sense that they would have their own e-wallet as well! Not only can you use GrabPay to book your rides and pay for GrabFood deliveries (a given) but you can also use GrabPay to make in-store purchases. Like most e-wallets, the payment method for GrabPay is by scanning a QR code. For each transaction, you could earn GrabRewards points, and those points could be used to obtain discounts or other deals.

2) Boost

Boost is arguably one of Malaysia’s most well-known and well-loved e-wallets, having more than 100,000 touchpoints online and offline. You can pay with Boost by scanning a QR code, and top up methods include online banking or through credit/debit cards. By using Boost, you stand to earn amazing rewards such as cashback, vouchers and promotions. Besides that, they also have a BoostUP Loyalty Program, where you get Boost coins with each transaction, and “shake” to get vouchers and prizes among other rewards.

3) Touch ‘n Go eWallet

Owned by TNG Digital Sendirian Berhad, Touch ‘n Go eWallet is an all-in-one e-wallet service that covers all existing and future Touch ‘n Go products and services. That means yes, you can top up your TNG card using this e-wallet. Touch ‘n Go eWallet runs seasonal contest and special promotions all year round, plus you can pay at more than 80,000 touchpoints nationwide. As with the above two e-wallets, you pay by scanning a QR code.

4) Bigpay

Bigpay was launched by AirAsia in 2018, and it’s slightly different than the rest. Instead of just being an app, Bigpay has a prepaid card attached to the app. In other words, the card becomes your e-wallet. The highlight of this is that the card is accepted worldwide. Hey, have Bigpay, will travel! Pay using Bigpay while booking flights with AirAsia, and earn discounts on your flights. Furthermore, you can also earn BIG points with each transaction, and use them to redeem free flights after a certain amount.

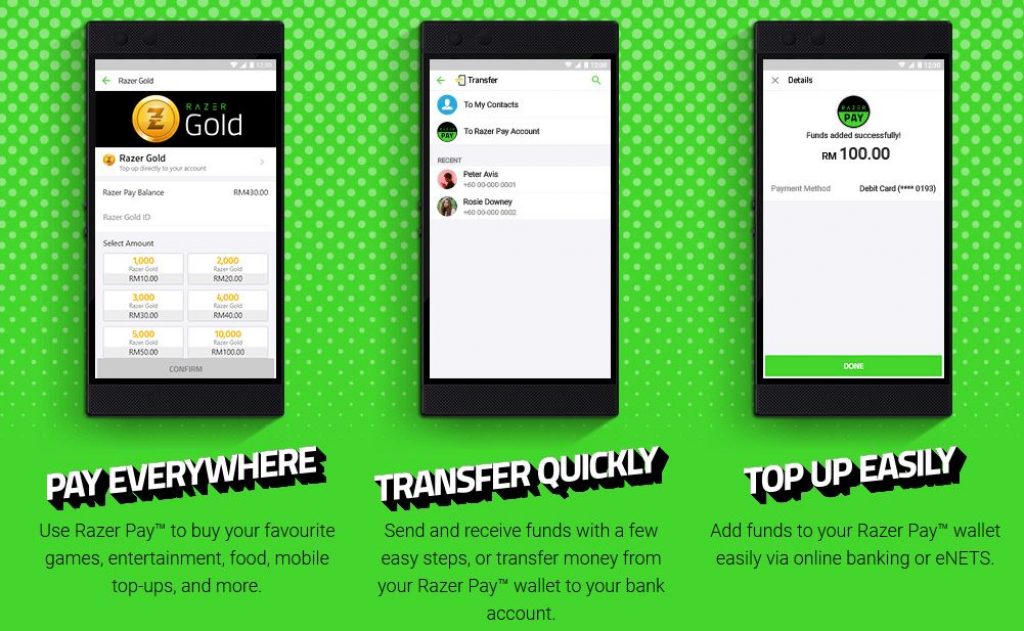

5) Razer Pay

According to their website, Razer Pay is an “e-wallet app designed for youth and millenials”. It features a robust and secure payment system, and allows for transfer and receiving of funds easily. Besides topping up using online banking and debit cards, you can also opt to top up at 7-Eleven. Currently, you can use Razer Pay at more than 10,000 major retail and F&B outlets, and enjoy certain promotions when you use it.

6) Setel

Setel is a specific sort of e-wallet, but it’s an e-wallet nevertheless. By Petronas, you use Setel to pay for fuel – at Petronas stations, of course. If you have an existing Mesra card, you can also link and activate your Mesra card on the app, and gain Mesra points that way. In fact, it is Malaysia’s Pay, Pump & Go app, and it’s been quite well-received by users. Pay for your fuel from the comfort of your vehicle and only exit when you need to pump!