Singapore has been consistently ranked as one of the best cities in Asia – for quality of life and the (3rd worldwide) to work in, according to the Global Competitiveness Report by the World Economic Forum. And in this article, we consider the 6 things Singapore Government does to help its citizen.

1) Housing

Singapore citizens over the age of 21 years old are eligible to purchase flats from the Housing & Development Board (HDB) and are eligible for HDB housing loans at concessionary interest rates or a CPF housing Grant.

2) Central Provident Fund (CPF)

Singapore allows you to be responsible for your own medical bills, education and property investment, by insisting that you save. CPF is an amazing and ingenious invention, where it has effectively created property millionaires across the island of people who could never be a millionaire in any other country simply by that old fashioned way – saving!

The overall scope and benefits of the CPF encompass the following:

- Retirement– The CPF Minimum Sum provides for basic needs in retirement. It can be used to purchase a life annuity from a participating insurance company, placed with a participating bank, or left in the Retirement Account with the CPF Board.

- Healthcare– Medisave healthcare is used to cover hospitalization expenses for both members and their dependants. It may also be used for specific outpatient treatments, such as chemotherapy and radiotherapy.

- Home Ownership– Ordinary Account savings can be used to purchase a home under CPF housing schemes. A HDB flat may be purchased under the Public Housing Scheme, or a private property under the Residential Properties Scheme.

- Family Protection– The Dependants’ Protection Scheme helps families to tide over the first few years in the event of an insured member’s permanent incapacity or death.

- Asset Enhancement– CPF members may invest their Ordinary Account balance under the CPF Investment Scheme – Ordinary Account (CPFIS-OA), and their Special Account balance under the CPF Investment Scheme – Special Account (CPFIS-SA).

3) Education

Singapore citizens enjoy significantly lower tuition fees compared to SPRs and foreigners, whether at government, government-aided or independent schools or institutions. Besides, The Edusave Scheme is a government initiative to maximize opportunities for all children who are Singaporean citizens. The Scheme includes the following:

- Edusave pupils fund– students studying full time at primary or secondary level in a Government or Government-aided school, an independent school or institution, a specialised school or Government-supported special education school will automatically be given an Edusave account and receive a yearly Edusave contribution of $200 or $240 respectively.

- Edusave Scholarships– students who excel in academic and non-academic activities are rewarded with various scholarships and awards.

- Tertiary Education– Singapore citizens are usually only required to undertake a service bond if they are on Public Service Commission scholarships/bursaries or if they are admitted to the Faculties of Medicine or Dentistry, whereas SPRs and foreign students are required to undertake a service bond under the terms of the tuition grant to work for a Singapore-registered company for three years upon completion of their degrees so as to discharge some of their obligations to the Singapore public for the high subsidy to their university education.

4) Health Care

Medifund – This is an endowment fund to help Singapore citizens who are unable to pay for their medical expenses. SPRs and foreigners are not eligible for assistance.

Medisave – Medisave Account savings (which form a part of your CPF contributions) can be withdrawn to pay the hospital bills of the account holder and immediate family members, which includes hospitalization, day surgery and certain outpatient expenses.

The Community Health Assist Scheme – CHAS aims to provide accessible and affordable primary care services to more Singapore citizens, and covers acute conditions, ten chronic diseases and selected dental treatment.

Medical Fees – Singapore citizens get to enjoy subsidized fees at SingHealth Polyclinics and Government Hospitals.

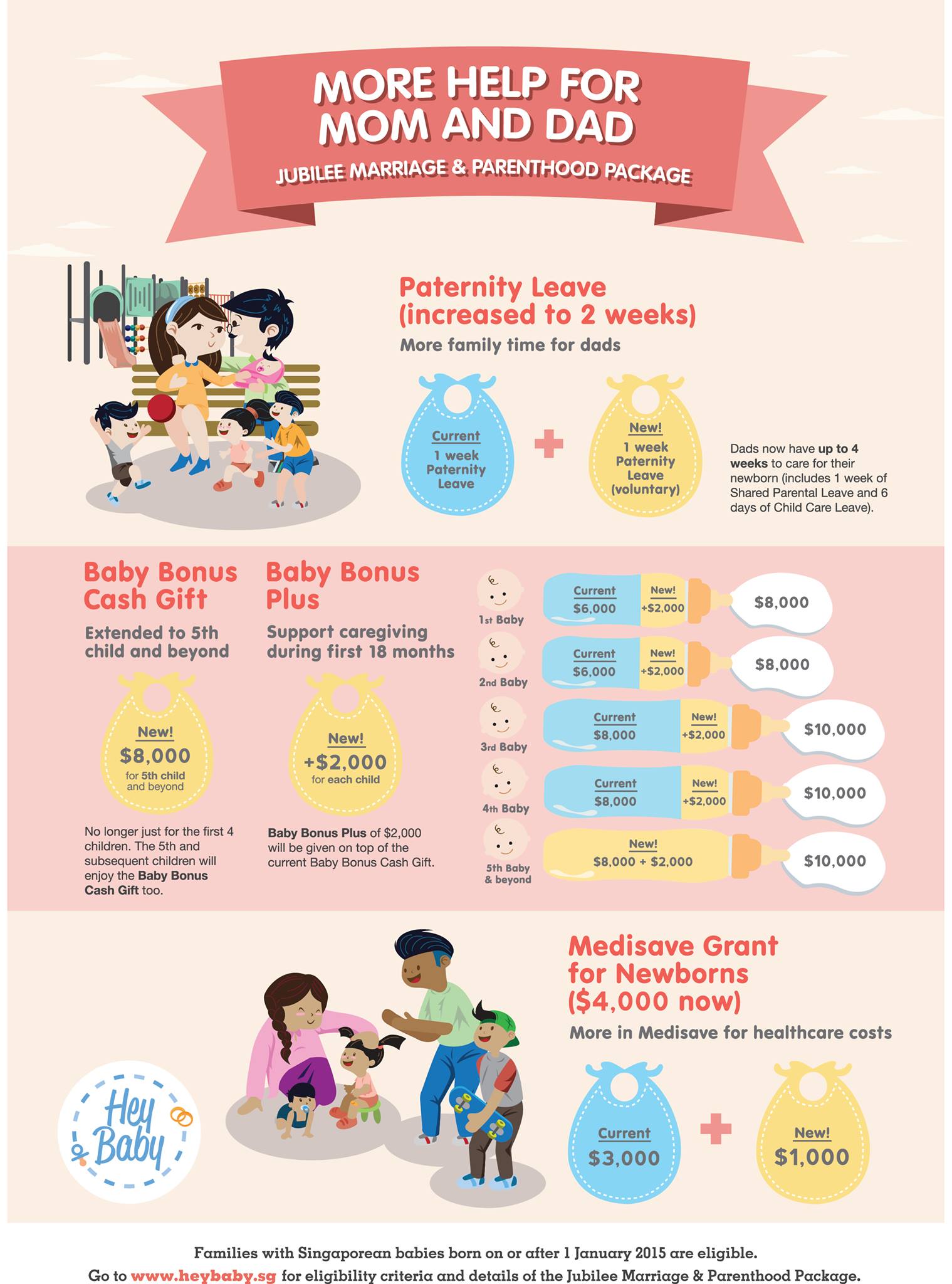

5) Leave Benefits

Maternity Leave – The mother of a Singapore citizen child is entitled to 16 weeks maternity leave.

Paternity Leave – The father of a Singapore citizen child is entitled to 1 week paternity leave. Fathers are also entitled to share 1 week of the 16 weeks maternity leave, known as Shared Parental Leave.

Childcare Leave – Parents of a Singapore citizen child under the age of 7 years are entitled to 6 days of childcare leave per annum (subject to certain criteria).

Extended Childcare Leave – Parents of a Singapore citizen child between the age of 7-12 years are entitled to 2 days of extended childcare leave per annum (subject to certain criteria).

Infant Care Leave – Parents of a Singapore citizen child are entitled to 6 days of unpaid infant care leave per annum (subject to certain criteria).

6) Parenthood Incentives

Baby Bonus Cash Gift – Parents of citizen newborns will receive $6,000 per child for the first two births and $8,000 per child for the third/fourth or more births.

MediSave – A CPF Medisave account will be created for each citizen newborn with a grant of $3,000 to further support parents in planning their children’s healthcare needs.

Child Development Account – CDA is a special savings account for eligible Singapore citizen children up to the age of 12 where the Government will match savings dollar-for-dollar up to the cap of $6,000 each for the first and second child, $12,000 each for the third and fourth child and $18,000 each for the fifth and subsequent child.

Parenthood Tax Rebate – Given to married Singapore citizens to encourage them to have more children. PTR can be used to offset income tax payable. The following PRT can be claimed for each qualifying child:

- 1st – $5,000

- 2nd – $10,000

- 3rd and beyond – $20,000 per child.

Working mother’s child relief – Working mothers who are married, divorced or widowed and have Singapore citizen children are eligible to claim the following tax relief for each qualifying child:

- 1st – 15% of mother’s earned income

- 2nd – 20% of mother’s earned income

- 3rd and beyond– 25% of mother’s earned income per child